BY AVIT NDAYIZIGA

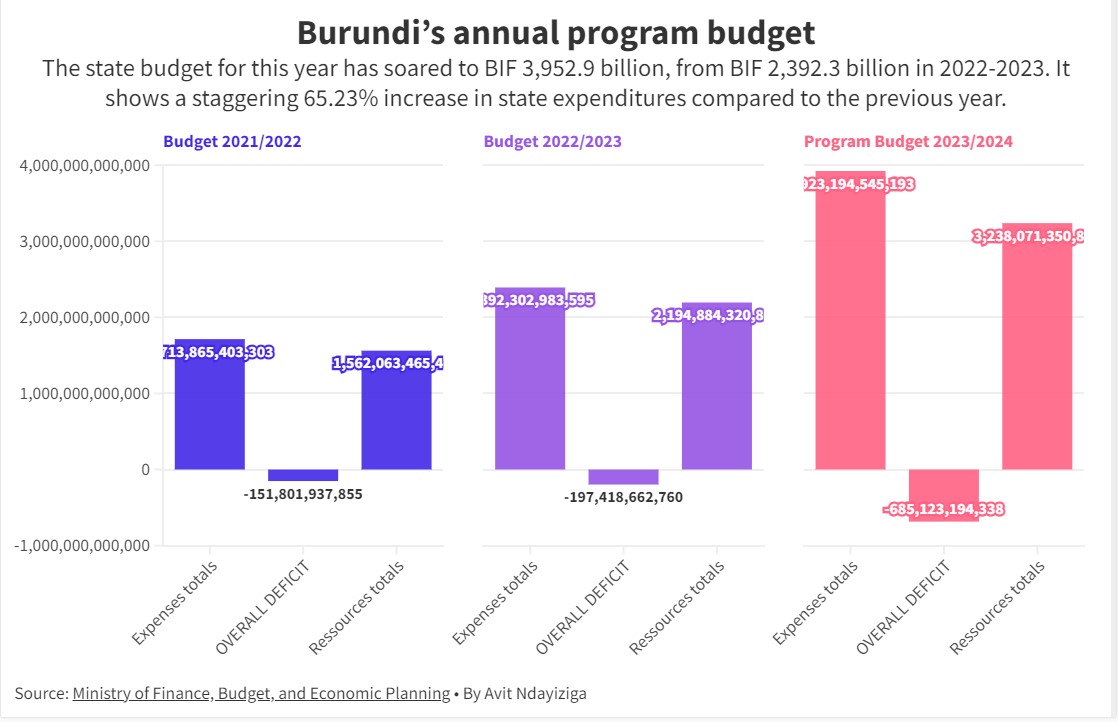

The state budget for this year has soared to BIF 3,923.1 billion, from BIF 2,392.3 billion in 2022-2023. It shows a staggering 65.23% increase in state expenditures compared to the previous year. According to experts, it will lay on consumption rather than investment canals.

Burundi recently unveiled its fiscal year 2023/2024 budget, which begins on July 1, 2023. Instead of being labeled a general state budget, this budget is referred to as a state program budget.

“This new budget form focuses on achieving results rather than allocating resources. Ultimately, this budget aims to improve the effectiveness of public projects,” says Audace Niyonzima minister of Finance, Budget, and Economic Planning while the bill draft of the budget presentation on June 12th, 2023 to the National Assembly that later amended and approbated the state program budget for 2023-2024.

As this public budget for the fiscal year 2023/2024 has been set at BIF 3,923.1 billion, it marks a considerable surge of 65.23% weighted to the previous budget of BIF 2,392.3 billion.

Audace states, ‘’This surge reflects the government’s commitment to revitalize the national economy’’.

As he continues, ‘’This budgetary expansion depends on strategic investments that align with the government’s key priorities. These priorities include enhancing public infrastructure, addressing domestic debt interest payments, and implementing a fair salary policy’’. He underlined.

The official funds, however, illustrate a remarkable disparity between revenues and expenditures.

Despite total revenue and donations reaching BIF 3,224.07 billion, state expenditure surpasses this amount by a considerable margin, totaling BIF 3,952.9 billion. This results in a substantial national budget deficit of 728.9 billion BIF.

A budget minister has shed light on how to deal with that deficit. Towards meeting this deficit, our plan calls for a net external financing of 148.1 billion BIF, coupled with a net domestic financing of 580.8 billion BIF. This will be achieved through the implementation of a new tax policy known as the Tax on Financial Activity (TAF). the banking sector, effectively replacing the existing Value Added Tax (VAT) on banking operations.” The minister concluded.

Legislators were not pleased with the proposed measures to address the government’s spending deficit.

Among others, Deputy Sylvestre Ngendakumana expressed his concern over relying on domestic borrowing and external financing to cover the budget deficit. ‘’There is already a high rate of domestic debt and continuing to borrow is not reassuring’’. He pointed out.

Additionally, he criticized the increase in taxes on mobile phone services as a way to broaden the tax revenue.

As for him, this increase will negatively impact phone users, many of whom are already struggling with a high cost of living. ‘’These taxes will make mobile telephony access difficult and benefit companies while burdening consumers’’. He argued

While the public funds have risen sharply, Gabriel Rufyiri, president of OLUCOME, a corruption watchdog association, says that this budget does not foster economic development. ‘This budget places a greater emphasis on consumption than investment,’ he says.

As for him, ‘Instead of prioritizing crucial and time-sensitive projects that would stimulate economic growth and generate revenue, particularly those related to tourism development, enhancing the country’s image, and farming industrial crops like cotton and tea, a greater amount of the budget is allocated towards operational expenses’’. Rufyiri pointed out.

“Let’s consider a basic illustration on a family,” Rufyiri stipulates this:‘’when consumption exceeds investment, the family cannot thrive’’. This year’s budget shows a higher emphasis on consumption with BIF 1968 Billion against BIF 1079 Billion allocated to investment.

Beyond that, when examining the major budget allocations for 2023/2024, such as salaries and wages (359.9 billion BIF) and military-police troop maintenance (143.4 billion BIF), it becomes evident that they do not contribute to economic growth but spendings. Gabriel concludes.

Overall, this year’s allocation for disbursement is BIF 1968 Billion. It represents a staggering growth of 68.3%compared to the previous of BIF 1204.5 Billion.

In contrast, investment in national resources will only see a modest increase from BIF 794.03 billion to BIF1079 Billion, a mere uptick of 33.3%.

Faustin Ndikumana, the leader of PARCEM, a Burundian civil society organization actively involved in promoting good governance, fighting corruption, protecting human rights, and fostering economic development, expresses his concerns regarding the rise in budgetary donations. He also laments the substantial debt interests that the government will have to pay.

“It is a major concern that this public expenditure will have to rely on BIF 938 billion coming from donations. Additionally, BIF 247 billion will be disbursed as interest from accrued debts. All of these, coupled with a deficit of 728.9 billion BIF, will force Burundi to fall into an economic pitfall,” warned Faustin.

As per the Central Bank data for 2022, Burundi grapples with a domestic debt of 4,005,281.9 billion and an external debt of 1,334,152.7 billion totaling 5339434.6 Billion.

According to this year’s public funds, central allocations include, among others, salaries and wages (359.9 billion BIF), runway rehabilitation at Melchior Ndadaye airport (50 billion BIF), and military-police troop maintenance (143.4 billion BIF). 32 billion BIF is allocated for the economic empowerment and youth employment program (PAEEJ), 256 billion BIF is allocated for fertilizer subsidies, and 35 billion BIF is allocated for the construction of administrative buildings.

One thought on “Burundi’s annual budget tips on consumption over investment, activists claim”